How an Iran Oil Tycoon Got Inside the Western Financial System Using Dominican Passport

31 December 2024

31 December 2024

SOURCE BLOOMBERG– On a winding road hugging Dominica’s palm-dotted shores stand a string of partially finished luxury hotels. A few miles north, sits the future home of the Portsmouth Marina — a development seeking to draw superyachts to the island.

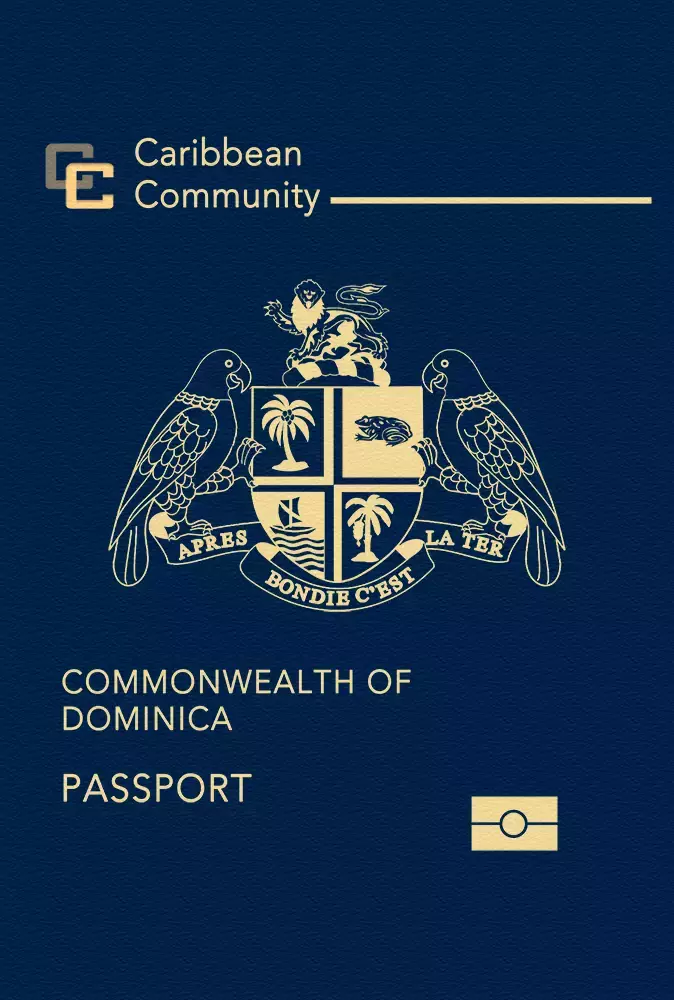

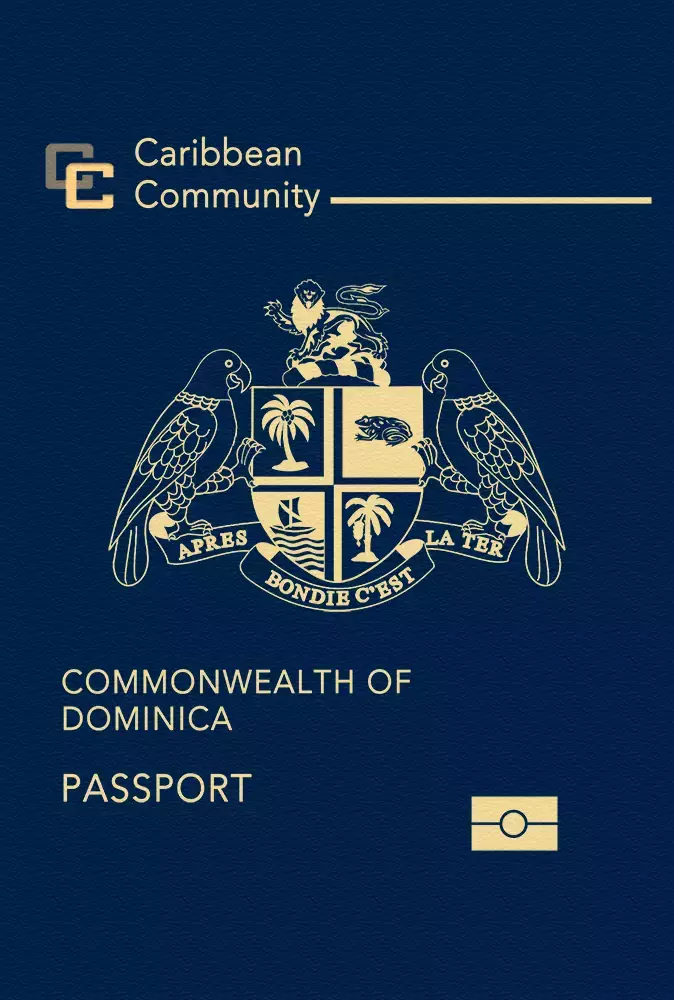

They are testament to a bet Dominica made three decades ago on citizenship by investment, or CBI. In essence, the tiny Caribbean nation has dished out passports to foreigners in exchange for significant lump sums. It’s brought billions into the economy, while offering an easy additional nationality to anyone whose origins might raise red flags in the financial community.

Among the willing customers for the six-figure program were a cadre of Iranians that included Hossein Shamkhani — the secretive leader of a business empire that handles strategically significant oil and arms deals for Tehran and Moscow, who also sits atop a hedge fund that’s operated in global finance hubs, according to people with direct knowledge of the matter, who requested anonymity to discuss confidential operations.

The acquisition of the Dominican documents by Shamkhani and his team was among a series of moves that allowed the Iranians to win widespread acceptance, including from Wall Street banks and Western oil majors. Shamkhani, whose father is a senior adviser to Supreme Leader Ayatollah Ali Khamenei, has made concerted efforts to keep his business interests confidential.

This story, based on interviews with more than four dozen people familiar with his network and the result of a year-long investigation, explains how Shamkhani successfully weaved the firms in his empire into the fabric of the Western financial system, even as key entities within his orbit handled Iranian arms deliveries to Russia. It identifies how he came to operate from London to Geneva, Dubai and Singapore — securing relationships with some of the biggest names in global finance.

A lawyer representing Shamkhani, who has consistently contested Bloomberg’s reporting on his business affairs, didn’t respond to specific questions for this story.

It takes in Malta and Cyprus, longstanding locales for getting citizenship in return for investment, and involves senior officials in the United Arab Emirates, a well-known lobbyist firm based a few blocks from the US Treasury Department in Washington and a clandestine logistics network moving billions of dollars of Iranian and Russian oil across the world’s oceans.

Step one was Dominica.

Born in Tehran just a few years after the Iranian revolution, Shamkhani grew up in the shadow of the Iran-Iraq War. His father held a range of senior government posts — naval commander for the Islamic Revolutionary Guard Corps and defense minister — before later getting tapped as secretary of Iran’s Supreme National Security Council.

With his father’s encouragement, the younger Shamkhani set out on his own to pursue a career in the private sector. After studying in Moscow and Beirut, he returned to Iran for a Master of Business Administration and then set up the trading firm Admiral Group — a nod to his father’s naval title — with his brother Hassan.

Dubai, just across the Persian Gulf with a large Iranian diaspora and a welcoming approach to business, proved a suitable base. But given his father’s positions and his own nationality, Shamkhani was a politically exposed person with ties to sanctioned entities — red flags for most big banks.

Dominica, roughly the size of New York City and home to some 70,000 people, offered a solution. Operating one of the world’s most flexible CBI programs since the early 1990s, the island had already generated billions of dollars from the initiative.

Better yet, physical presence isn’t required and CBI deals are regularly conducted via private brokers from Dubai, according to Kristin Surak, a professor at the London School of Economics and Political Science and author of The Golden Passport.

For a fee, Shamkhani and several close associates secured Dominican passports, according to people with direct knowledge of the matter, as well as documents and corporate records seen by Bloomberg. Some also changed their names — at the time, a completely legal procedure conducted via the island’s Deed Poll.

That on its own wasn’t enough.

Many banks asked for a second source of identification in line with basic know-your-customer guidelines. Their Iranian IDs clearly wouldn’t suffice. To alleviate such concerns, Shamkhani and his team used their Dominican documents to get additional passports from European Union nations including Malta and Cyprus.

With multiple foreign travel documents under aliases and alternate nationalities, the Shamkhani network could then pass compliance checks at some of the biggest names in international finance, who would otherwise have likely raised concerns over their place of birth, political exposure and ties to sanctioned entities.

Alongside Shamkhani, the Iranian nationals who secured Dominican passports included ship captain Alireza Derakhshan, nicknamed “Captain D,” who works closely with the trading firm Milavous Group Ltd.; Mahdiyar Zare Mojtahedi, a top executive at the hedge fund Ocean Leonid Investments; and Hossein Ghorbanizahed, a top associate at Golden Nest Group, who has helped Shamkhani cultivate global banking relationships.

Derakhshan obtained Dominican citizenship in 2009, according to data obtained by the Government Accountability Project. He also appears in a Turkish commercial registry as a Dominican national. In the UK, Companies House records list Zare and Ghorbanizahed as Dominican nationals.

In all three instances, no reference to Iran was made in the filings reviewed by Bloomberg.

Details on citizenship have been further obscured in recent years after the Dominican government stopped publishing foreign recipients in its Official Gazette, both past and present.

Transparency about who secured them ended in 2019 amid accusations from opposition politicians that Prime Minister Roosevelt Skerrit — in power since 2004 — personally benefited from the sales. (He has defended the program as “robust and very transparent.”) Some foreign banks subsequently cut ties with Dominica, citing efforts to de-risk, said Lennox Linton, a local lawmaker who’s raised concerns about CBI.

In July 2023, the UK ended visa-free travel for individuals with Dominica passports, setting off alarm bells across the Caribbean CBI industry. Meantime, the European Parliament has been debating whether to end such programs citing fraud and lax oversight.

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Related News

Antigua and Barbuda Set for Record-Breaking Year in Tourism

NO SUBSTANCE: PM Browne Responds to Criticism from Opposition Senator Pearl Quinn-Williams

Turning Business Setbacks into Success: The Power of Strategic Planning