Government Policies Help ACB and ECAB Earn Millions in Profits, PM Browne says

05 January 2025

05 January 2025

Antigua and Barbuda’s economic transformation over the past decade owes much to strategic interventions in the financial sector, spearheaded by the government of Prime Minister Gaston Browne.

A key focus of these efforts was the stabilization and strengthening of the banking industry, which had been on the brink of collapse in 2014.

Today, Antigua’s locally owned banks are thriving, posting record profits and demonstrating the success of policies aimed at fostering resilience and local ownership.

When the Browne administration took office, Antigua’s banking sector was in disarray. ABI Bank had failed, and Caribbean Union Bank was struggling to remain operational.

The government stepped in to restructure and consolidate the sector, implementing policies that prioritized local ownership and long-term sustainability.

These measures included facilitating the transfer of assets and liabilities to Antigua Commercial Bank (ACB) and Eastern Caribbean Amalgamated Bank (ECAB), ensuring stability for depositors and strengthening the institutions.

Prime Minister Browne highlighted the financial success of local banks as a direct outcome of these interventions. ACB, now a key player in the Eastern Caribbean banking sector, recently posted a net profit of over $40 million, while ECAB recorded profits exceeding $60 million in 2024.

Combined, the two banks generated approximately $100 million in net profits—a stark contrast to their precarious financial state a decade ago.

“The policies we implemented ensured that these institutions remained under local control, resulting in increased retained earnings and higher dividend yields for shareholders,” Browne said. “This is a success story of resilience and foresight.”

The Prime Minister underscored the importance of keeping these financial institutions locally owned.

He noted that retaining ownership within the country allowed profits to be reinvested into the local economy rather than being repatriated abroad.

This approach not only strengthened the banks but also provided a more stable foundation for Antigua and Barbuda’s financial system.

“By ensuring local ownership, we have created a stronger, more resilient banking sector that can withstand future economic shocks,” Browne added. “This is a safeguard for depositors and a testament to the effectiveness of our government’s fiscal policies.”

The banking sector’s turnaround is part of a broader strategy to enhance Antigua and Barbuda’s economic resilience.

The government’s actions, from resolving the challenges of failing banks to fostering profitability, demonstrate a commitment to building a sustainable and thriving financial ecosystem.

As the nation enters 2025, Browne expressed confidence that the policies driving growth in the financial sector would continue to benefit the country.

“We have laid the groundwork for a prosperous future,” he said. “Through bold decision-making and strategic planning, we are building an economy that works for all Antiguans and Barbudans.”

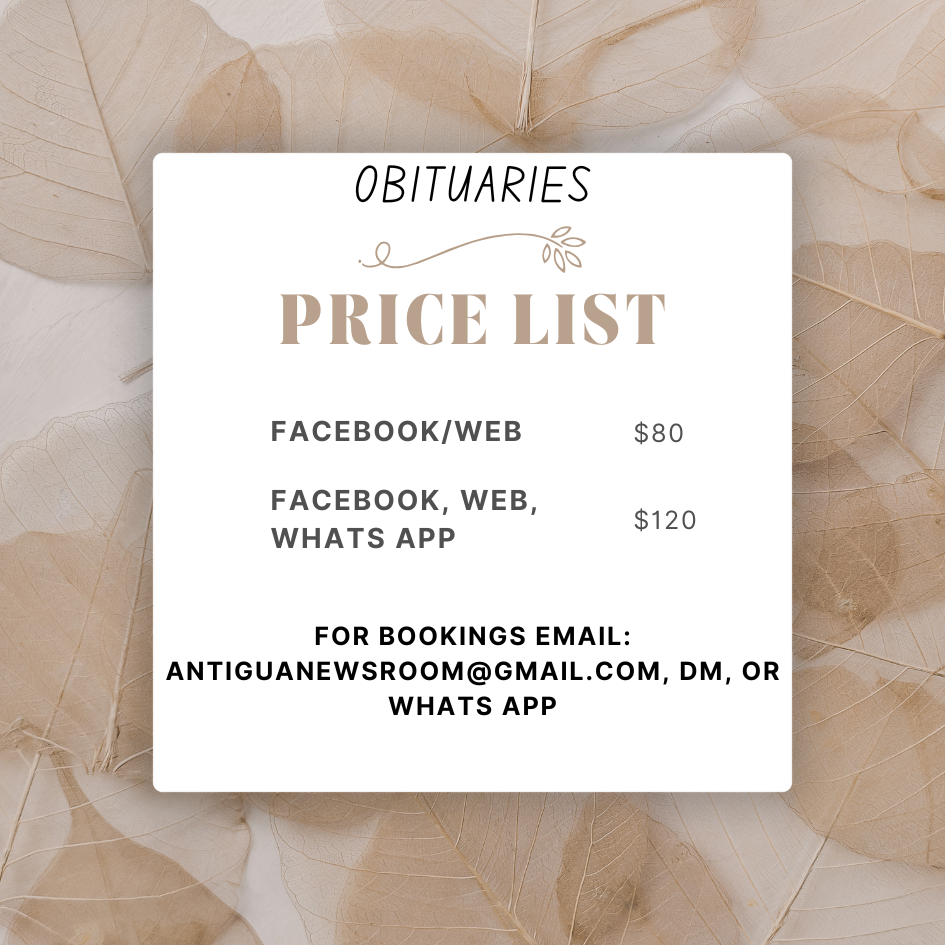

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Related News

The Gift of Giving: A Message of Love and Community

LETTER: Curfew for minors still ah keep?

JCI Honours Ariel Derrick for Outstanding Leadership as Rotaract Club President