OPINION: Do you know that you work two months free every year for the Antigua and Barbuda government?

22 December 2025

22 December 2025

Every year, the budget of the Antigua and Barbuda government grows larger and larger.

Surprisingly, most people appear unconcerned. Politicians speak as if spending more is a badge of honour.

It is as if the citizens of this country believe that government’s increased spending has no impact on the cost of living, whatsoever.

Here is what the government had estimated it would have spent for the last 5 years:

2021 – $1.499B

2022 – $1.642B

2023 – $1.802B

2024 – $1.865B

2025 – $2.001B

The budget grew 33.5% over those five years.

The government now plans to spend $2.078B in 2026. A 38.6% increase over 2021.

Wonder why the cost of living keeps skyrocketing?

It is the indirect (hidden) taxation that is making life increasingly unbearable!

What is not immediately apparent to the people of this country is that for government to spend a single dollar, is must first take that dollar from the citizens of this country. The money that government spends does not come out of thin air. It comes out of YOUR pocket!

Even if the government borrows the money to spend, that just merely delays when we will inevitably have to pay. But pay we all will, even if our children wind up paying it back.

As citizens we have to decide how much we are willing to allow the government to fleece us before we are prepared to push back and say enough is enough.

Because the majority of taxes we pay are hidden in our consumption, it is not immediately apparent how much taxes we are actually paying out of your paycheck.

It is my intent in this post to demonstrate from the data that is already in the public domain how much tax you pay as an individual.

In the 2026 budget, we are told that our national income (GDP) is taxed 18%. We can extrapolate that the average individual income is taxed at 18%, based on indirect taxation. I make this assumption in the absence of data to the contrary.

It is noteworthy, that our government subtly implied that Antigua and Barbuda citizens are somehow better off than our neighbours in the Eastern Caribbean Currency Union, who are taxed on average, 20%.

I do not think that this is a good benchmark. To me the goal should be based on how little the government spends compared to tax revenues. We do not want the government to waste resources which comparison can promote.

The government’s objective, in my opinion, is to make sure we, citizens keep as much of our income for ourselves so that we can realise and support ourselves and dreams.

18% GDP, in my objective opinion is too high.

18% indirect taxation, effectively equates to the government mulcting $1 of every $5 that you earn. If I had it my way, I would aim to limit the size of the government’s budget to never be more than 10% of the national income.

Any reasonable person would agree that government spending cannot be open ended.

It should be understood that these indirect taxes must be paid in addition to the statutory deductions taken by the government, which includes Social Security, Medical Benefit and Education Levy.

Below, I will demonstrate by way of an example how you are being affected by the indirect taxes.

We are told that the average salary in Antigua and Barbuda is EC$3000.00 per month, so if we assume this, then here is how a typical single person’s budget may look like:

SALARY: $3000.00

LESS DEDUCTIONS:

– MB/SS/EL $376.00 (statutory deductions)

– Housing $900.00 (could be rent, mortgage, etc)

– Utilities: $500.00 (topups, electricity, water, internet)

– Indirect Taxes: $540.00 (based on 18% of national income)

– Daily Meals: $200.00 ($10 per meal for a 5 day work week)

– Groceries: $400.00 ($100 per week for a single person)

TOTAL DEDUCTIONS: $2916.00

SURPLUS: $84.00

Out of the surplus of $84.00, you have to pay for cooking gas, bus fare, incidentals, entertainment.

It is clear that anyone making $3000.00 per month in Antigua and Barbuda is having a very rough time and no increase in the minimum wage would make that better.

As you can see a total of $916.00 ($376.00+$540.00) per month goes to the government both directly and indirectly. This means that 30.5% of your income goes to the government every month.

Yes, 30.5%!

This is why so many people are feeling the crunch. You wonder why there is so much month left at the end of the pay? This is your answer!

With no appreciable salary increase in your near future any increase of government’s annual budget will naturally give you less money in your hand to support yourself.

Knowing what you now know, are you still excited for government to continue ballooning its annual budget?

Are you prepared to give more than $916 per month to the government out of your $3000 salary?

If you say no, then you must join me vociferously to tell the government: “NO to budget increases!”

For someone being paid $3000.00 per month, if we look at what you pay annually in indirect taxes (18%), that equates to working for the government for free for two months a year.

As it stands now, you are already working 2 full months a year to pay for all of your indirect taxes, alone. The 10 month income you receive is required to pay your bills and statutory deductions for 12 months a year.

The two months free labour is already a great sacrifice in my opinion.

Some may argue that as a citizen, that is the price you pay for nation building.

Granted!

But I must remind you that one definition of a slave is a person where 100% of his effort benefits a third party. If we do not curb government’s spending, the 18% could easily grow to 80%, making virtual slaves of everyone.

The government is supposed to be slave to the people and not the other way round!

Government needs to reduce its spending, now!

Advertise with the mоѕt vіѕіtеd nеwѕ ѕіtе іn Antigua!

We offer fully customizable and flexible digital marketing packages.

Contact us at [email protected]

Related News

Regional Leaders Attend Swearing-In of Saint Lucia’s Prime Minister Philip J. Pierre

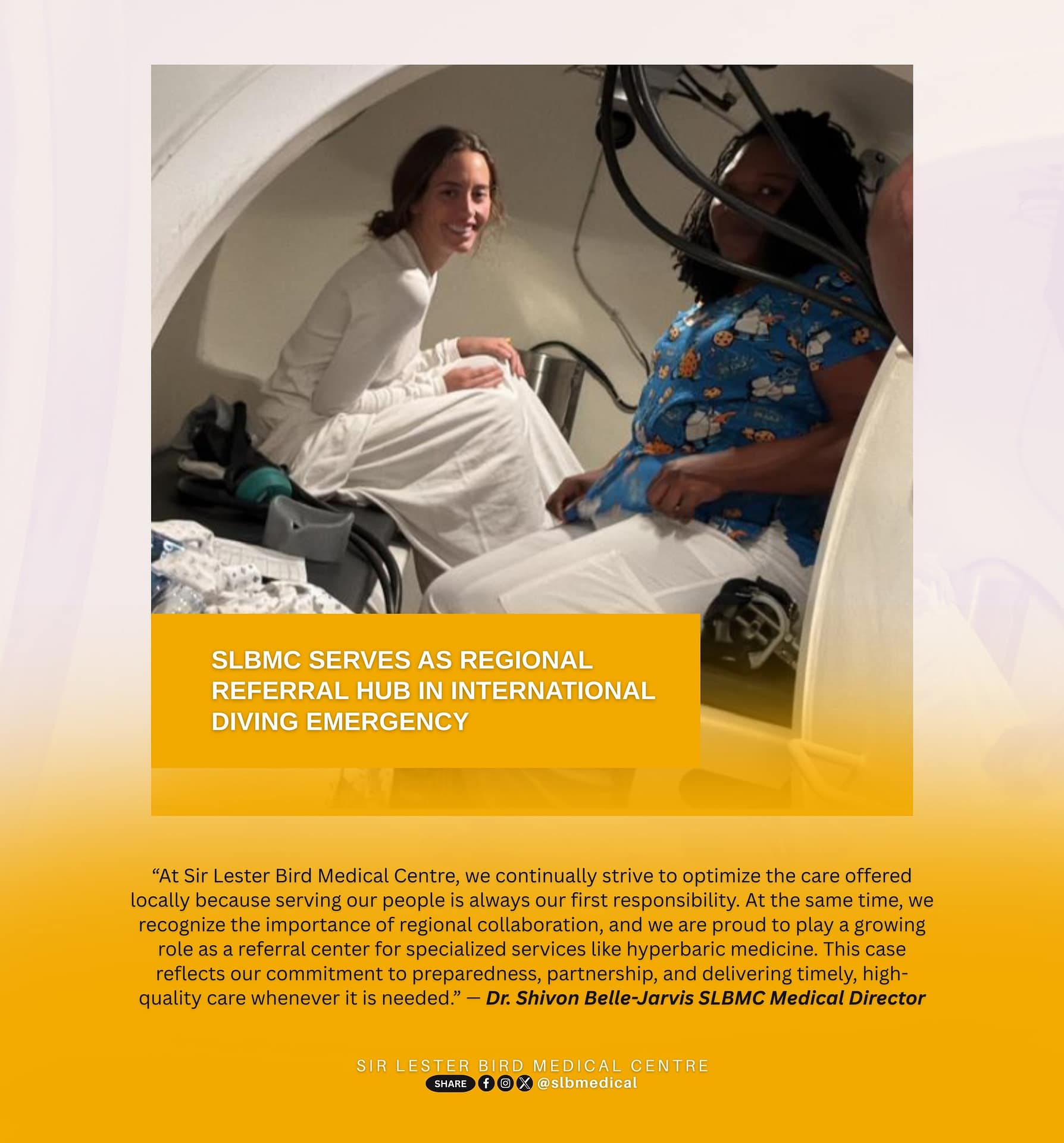

Antigua Hospital Provides Urgent Hyperbaric Care to Diver From British Virgin Islands

Attorney General Suggests The Need for A Senate Should Be Reviewed in Constitutional Refor...